Oil is one of the most vital commodities in the world, playing a crucial role in shaping not only energy markets but also the broader economic landscape. Changes in oil prices can have profound impacts on global economic stability, influencing everything from inflation rates to currency values and international trade.

Understanding Oil Prices

What Determines Oil Prices?

Oil prices are determined by a variety of factors, both on the supply and demand sides:

Supply Factors: These include the production levels set by major oil-producing countries, geopolitical stability in key oil regions, and technological advancements in extraction methods. The Organization of the Petroleum Exporting Countries (OPEC) plays a pivotal role in regulating oil supply and influencing prices.

Demand Factors: Demand for oil is influenced by global economic growth rates, energy consumption patterns, and the emergence of alternative energy sources. Economic expansion typically increases demand for oil, while economic downturns may lead to reduced consumption.

Geopolitical Events: Conflicts, sanctions, and political instability in oil-producing regions can disrupt supply chains and lead to price volatility. Such events often create uncertainty in the market, prompting traders to react swiftly.

Market Speculation: Traders and investors also influence oil prices through speculation. Futures contracts, hedge funds, and other financial instruments can lead to short-term price fluctuations based on market sentiment.

The Importance of Oil as a Commodity

Oil is not only a source of energy but also a vital input for various industries. It is used in the production of goods, transportation, agriculture, and even in the creation of countless consumer products. Consequently, changes in oil prices can ripple through the economy in numerous ways.

The Relationship Between Oil Prices and Economic Stability

1. Inflation and Cost of Living

One of the most direct effects of rising oil prices is the impact on inflation rates. Higher oil prices can lead to increased transportation and production costs, which can be passed on to consumers through higher prices for goods and services:

Transportation Costs: As oil prices rise, the cost of shipping goods increases. This can result in higher prices for consumer products and essential goods, impacting overall living costs.

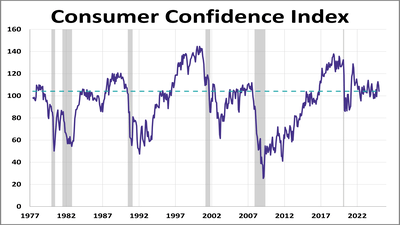

Consumer Behavior: With higher living costs, consumers may cut back on discretionary spending. This reduction in consumer demand can hinder economic growth and strain businesses.

Central Bank Response: Central banks often respond to rising inflation by adjusting interest rates. If oil prices contribute to sustained inflation, central banks may increase rates to curb inflationary pressures, which can further impact economic growth.

2. Currency Values

Oil prices also have significant implications for currency values, particularly for oil-exporting and oil-importing nations:

Oil-Exporting Countries: Countries that are major exporters of oil, such as Saudi Arabia and Russia, often see their currencies appreciate with rising oil prices. Increased revenues from oil exports bolster their national economies, enhancing the strength of their currencies.

Oil-Importing Countries: Conversely, nations that heavily rely on imported oil, such as many European countries and Japan, may experience currency depreciation as oil prices rise. Higher oil import costs can contribute to trade deficits, putting downward pressure on the national currency.

3. Economic Growth

The relationship between oil prices and economic growth is complex. While rising oil prices can pose challenges, they can also provide benefits under certain conditions:

Investment in Energy: Higher oil prices can stimulate investment in energy infrastructure and alternative energy technologies. This investment can lead to job creation and economic diversification, especially in regions rich in natural resources.

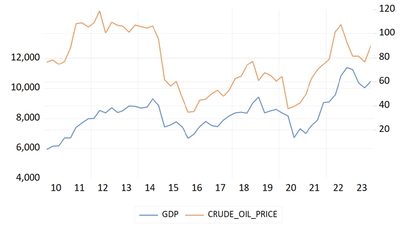

Impact on GDP: In oil-exporting countries, higher oil prices can lead to increased GDP growth as revenues rise. In contrast, for oil-importing nations, higher prices can hinder economic growth by limiting spending power and increasing production costs.

4. The Impact on Emerging Economies

Emerging economies are particularly sensitive to oil price fluctuations. Many of these economies rely heavily on oil imports to fuel their growth, making them vulnerable to rising prices:

Economic Vulnerability: In emerging markets, rising oil prices can lead to higher inflation, increased trade deficits, and reduced consumer spending. These factors can destabilize economies and create challenges for policymakers.

Opportunities for Growth: On the other hand, some emerging economies with oil resources may benefit from rising prices. Countries like Nigeria and Brazil can see increased revenues and investment opportunities, fostering economic growth.

Oil Prices in the Context of Global Events

1. Geopolitical Tensions

Geopolitical tensions in key oil-producing regions can lead to significant price volatility. Events such as conflicts in the Middle East, sanctions on oil-producing nations, or political instability can disrupt oil supplies and drive prices higher:

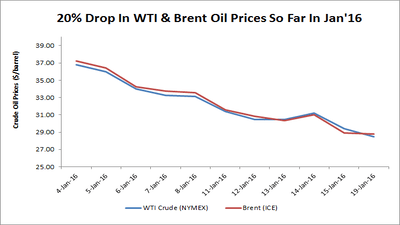

Market Reactions: Traders often react to news of geopolitical tensions, causing immediate fluctuations in oil prices. This reaction can create uncertainty in global markets and influence the broader economy.

Long-Term Impacts: Prolonged geopolitical instability can lead to sustained high oil prices, which can have far-reaching consequences for global economic stability.

2. Natural Disasters and Supply Chain Disruptions

Natural disasters, such as hurricanes or earthquakes, can disrupt oil production and refining processes, leading to sharp price increases:

Hurricane Impacts: The 2005 Hurricane Katrina significantly disrupted oil production in the Gulf of Mexico, causing prices to surge. Such events highlight the vulnerability of oil supply chains to external shocks.

Emerging Supply Chain Risks: As climate change brings more frequent extreme weather events, the stability of oil supply chains may be increasingly tested, impacting prices and economic stability.

The Role of Government and Policy

Government policies also play a critical role in shaping the relationship between oil prices and economic stability:

1. Fiscal Policy

Governments may implement fiscal policies aimed at mitigating the impacts of rising oil prices on consumers and businesses:

Subsidies and Tax Relief: Some governments provide subsidies for transportation costs or tax relief to help offset rising energy prices. These measures can alleviate the financial burden on consumers.

Investment in Alternatives: Governments may increase investment in alternative energy sources to reduce dependence on oil. This transition can enhance energy security and stabilize economies over the long term.

2. Monetary Policy

Central banks closely monitor oil prices and their effects on inflation and economic growth:

Interest Rate Adjustments: If rising oil prices contribute to inflationary pressures, central banks may raise interest rates to control inflation. Conversely, in the face of economic downturns fueled by high oil prices, central banks may lower rates to encourage investment and spending.

Quantitative Easing: In some cases, central banks may implement quantitative easing measures to stimulate economic activity during periods of high oil prices and stagnation.

3. International Cooperation

Given the global nature of oil markets, international cooperation among nations is vital for maintaining economic stability:

OPEC and Production Decisions: OPEC plays a crucial role in regulating oil production levels to stabilize prices. Collaborative efforts among member nations can influence global oil supply dynamics.

Global Energy Strategies: Nations may work together to develop comprehensive energy strategies aimed at diversifying energy sources and enhancing energy security in the face of fluctuating oil prices.

The Future of Oil Prices and Economic Stability

1. Transition to Renewable Energy

The global transition toward renewable energy sources poses opportunities and challenges for oil prices and economic stability:

Decreasing Demand for Oil: As countries prioritize reducing carbon emissions and investing in renewable alternatives, long-term demand for oil may decline. This shift could lead to lower oil prices and impact economies reliant on oil revenue.

Investment Opportunities: The energy transition may create new investment opportunities in sustainable technologies, influencing the global economic landscape. Governments and businesses must adapt to these changes to remain competitive.

2. Technological Advancements

Advancements in technology, such as hydraulic fracturing and horizontal drilling, have transformed the oil and gas industry, leading to increased production capacities:

Supply Surges: Technological improvements can lead to increased oil production, potentially stabilizing prices in the long term. However, oversupply can also result in price collapses, impacting economic stability.

Alternative Energy Innovations: Continued innovations in alternative energy technologies may further reduce the world's reliance on oil, impacting demand dynamics and pricing structures.

Conclusion

Oil prices play a critical role in global economic stability, influencing inflation, currency values, economic growth, and the broader financial landscape. The intricate relationship between oil prices and economic indicators underscores the need for individuals, businesses, and policymakers to stay informed and proactive in adapting to changing market conditions.

As the world navigates a transition toward renewable energy, technological advancements, and geopolitical uncertainties, the effects of oil prices on economic stability will continue to evolve. Understanding this relationship equips stakeholders with the knowledge necessary to make informed decisions in an increasingly complex economic environment.

By recognizing the multifaceted implications of oil prices, we can better appreciate their impact on our daily lives and the global economy at large.